https://getmetrics.ca/taxes/tax-determining-your-canadian-residency

Tax: Determining Your Canadian Residency

The Canadian tax system determines an individual’s tax obligations based on their residency as opposed to their citizenship in the country. This is an important distinction to understand; for example, you may be a Canadian resident for tax purposes while not a Canadian citizen or immigrant. You can be a Canadian citizen but not a Canadian resident. This article outlines the conditions required for an individual to be deemed a Canadian resident and the tax implications of their determined status.

Determining Residency

The CRA assesses residency on an individual basis using residential ties that a person maintains in Canada. There are two main types of residential ties in Canada: significant and secondary ties. For an individual to be a resident of Canada, they must meet one of the three significant residential ties. The secondary ties are used to complement the significant ones and help the CRA paint an accurate picture; on their own, however, they are not sufficient to establish Canadian residency. Below is a listing of the significant and secondary ties.

Significant ties to Canada:

A home or dwelling in Canada

A spouse or common-law partner in Canada

Dependents in Canada

Secondary ties to Canada that may be relevant:

Personal property in Canada, such as a vehicle

Social ties in Canada, such as membership in a recreational or religious organization

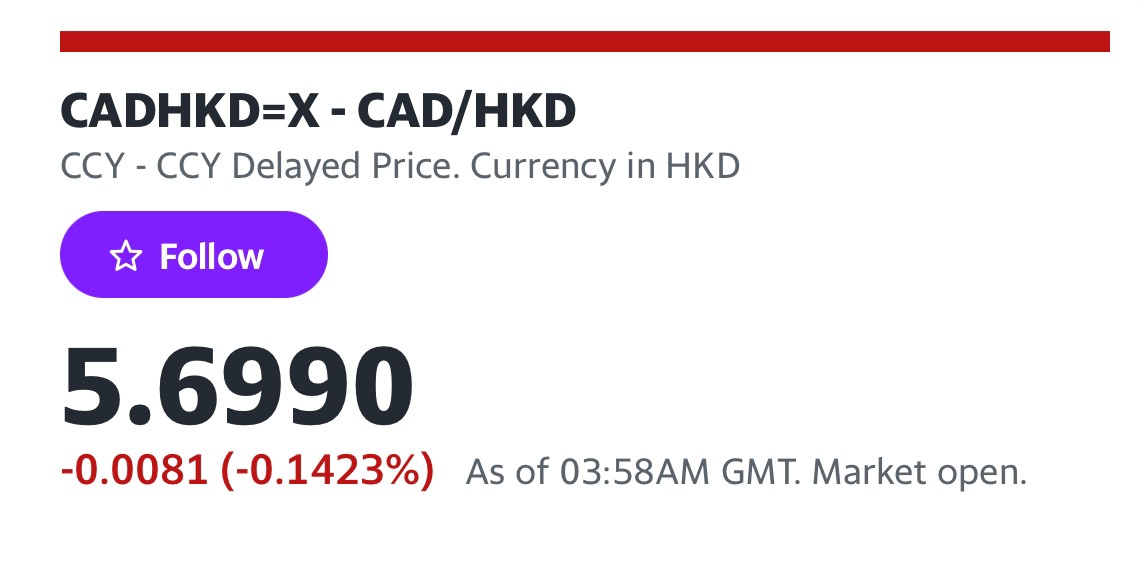

Economic ties in Canada, such as a bank account

A Canadian driver’s license

A Canadian passport

Health insurance with a Canadian province or territory

The CRA splits up taxpayers into two main categories: residents and non-residents. The tax obligations for each category are as follows:

Residents: As a resident of Canada, you must report all worldwide income (income that you receive from inside and outside of Canada) in your income tax return. You must also pay federal and provincial/territorial taxes that apply to the location where you hold your significant residential ties.

A factual resident of Canada is an individual who is not currently living in Canada either for schooling, work, vacation, etc. but they still maintain their significant residential ties in the country. In this situation, the tax obligations of a resident apply.

A deemed resident of Canada is different in that they do not hold significant residential ties in Canada. However, they still fall under the category of residents because they spend 183 days or more in Canada during the tax year, as per the 183-day rule. They are also not considered residents in the country where they currently reside. Deemed residents must still report world income but they only have to pay the federal income tax and an additional federal surtax. An international corporation may also be considered under this category under the condition that it was incorporated in Canada.