Introduction to Stochastic Calculus & Application in Finance

宇智波月巴

674 回覆

359 Like

8 Dislike

It doesn’t work

first generation exotic:

european barrier, digital, continuous barrier, kiko

second generation exotic:

chooser, asian, lookback, fwd start, tarf, vol or var swap

but normally we dont call european barrier or digital "exotic" now as you can replicate it as vanilla combination

european barrier, digital, continuous barrier, kiko

second generation exotic:

chooser, asian, lookback, fwd start, tarf, vol or var swap

but normally we dont call european barrier or digital "exotic" now as you can replicate it as vanilla combination

So basically it’s an ever changing term in the market

Sooner or later some of the exotic products will not be as “exotic” as before due to its replicability and liquidity/trading vol

Sooner or later some of the exotic products will not be as “exotic” as before due to its replicability and liquidity/trading vol

推下先

連續兩日兩個midterm

應該今個weekend有新post

連續兩日兩個midterm

應該今個weekend有新post

4.) Girsanov Thoerem (Change of measure) & its application

e.g. Exchange option

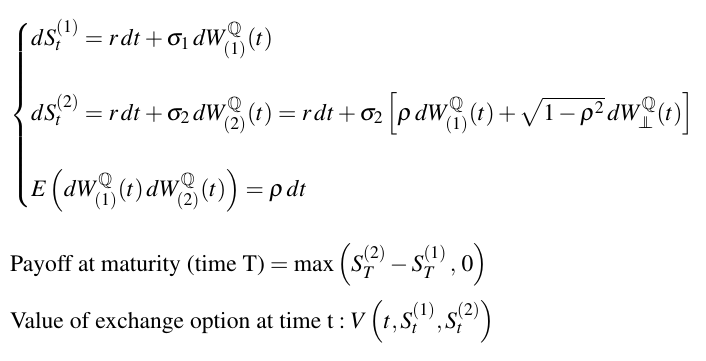

(i) Background review

考曬midterm之後又可以繼續出post

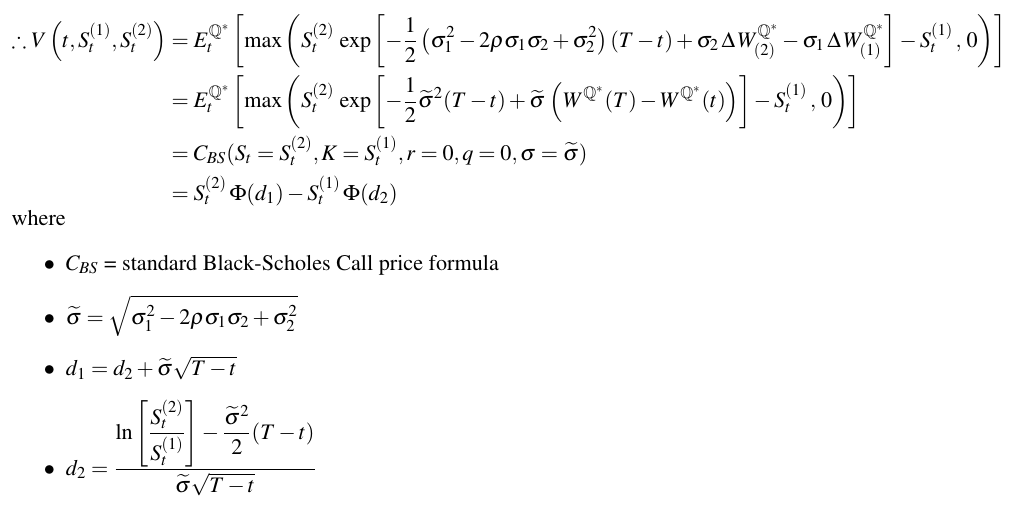

首先review一次 Cholesky decomposition 先 跟住就可以講 exchange option

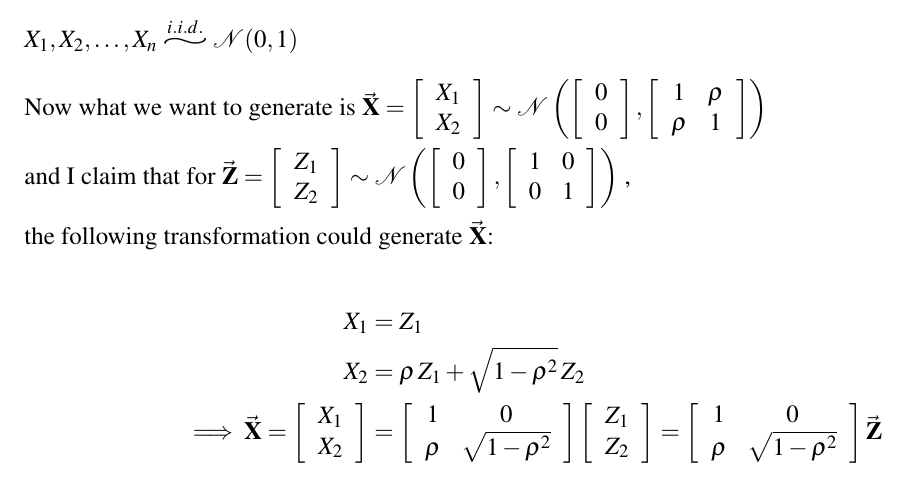

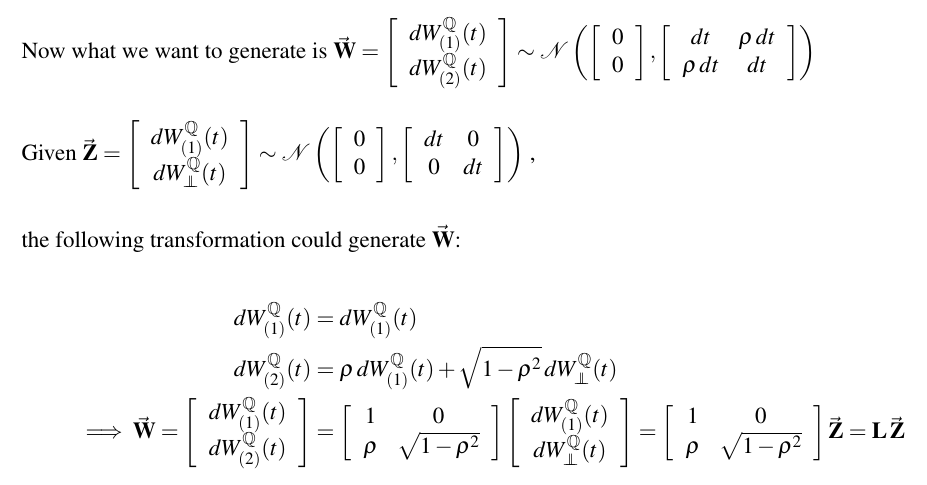

上次最尾我地講到可以用下面幅圖嘅 transformation 去 generate 兩粒 correlated 嘅 bivariate normal R.V.s

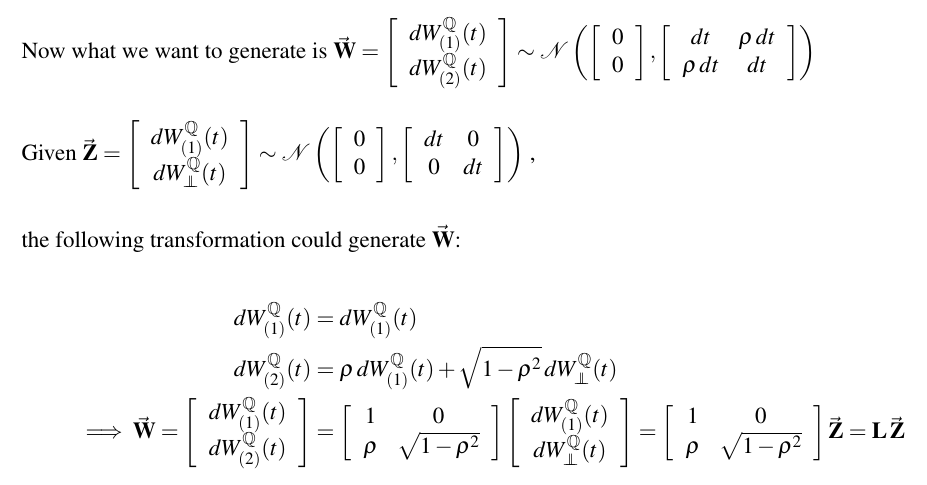

而去到 wiener processes 身上

其實個 transformation 都係一模一樣 而呢個做法就係 (2D版) Cholesky Decomposition

(p.s. n dimension版我會留返講 simulation 嗰時先處理 大家唔洗擔心我肯定會講)

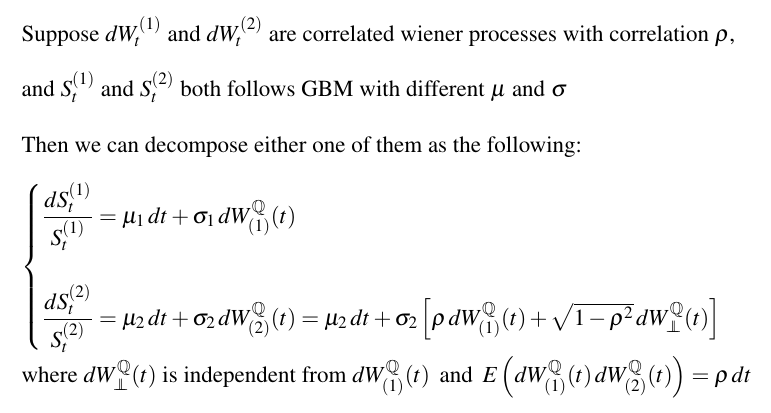

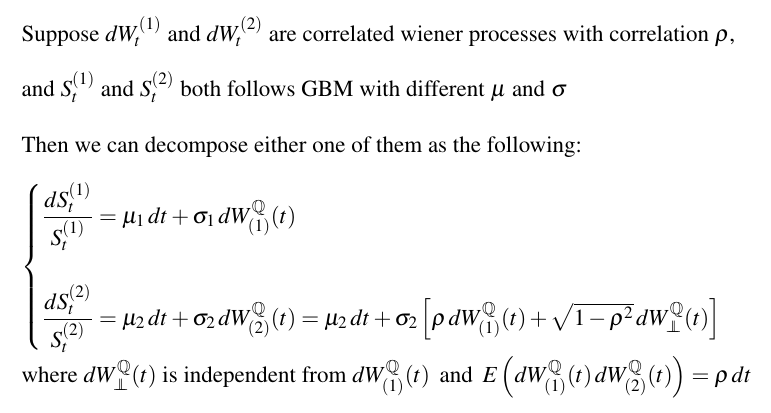

咁再將呢個 technique 放落去兩條 GBM 入面就會變咗下圖咁

最尾個結果就係我地將自己心目中嘅 correlation structure 加咗入去呢兩條 SDE 入面

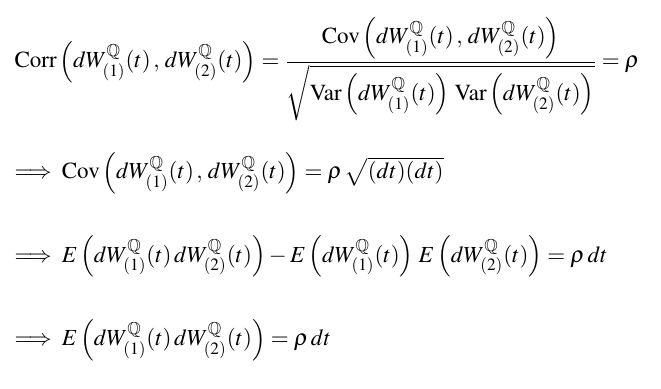

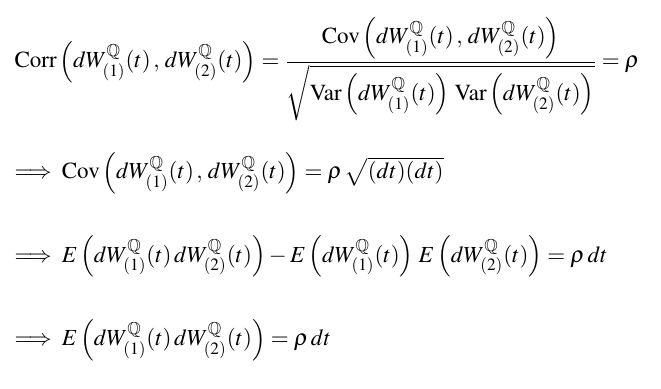

你地應該會問 最尾嗰舊 E(...) = ρdt 係想講乜?

唔緊要 大家可以用一個 好heuristic 嘅方法去諗

所以大家可以當呢句係講緊兩條 wiener processes 嘅 covariance 係 ρdt

亦即係 imply 緊佢地嘅 correlation 就係 ρ

----------------------------------------------

(ii) Structure

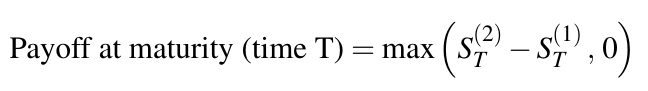

Exchange option 最簡單嘅版本應該剩係牽涉兩隻stock 1 同 2

咁同之前一樣我剩係會討論 european exchange call option

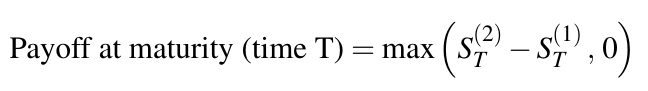

呢隻 deriv 喺 maturity (Time T) 嘅 payoff 就係:

如果照字面上理解就係喺maturity嗰時

我地會賣咗 stock 2 同時買返 stock 1

咁話明係call option 如果上面咁樣做我地賺唔到錢自然就唔會exercise呢隻option

而買邊隻賣邊隻其實都係 issuer 同 investor 自己定

甚或乎個payoff可以係賣1手 stock 2 同時買返3手 stock 1 都ok

總之 issuer 同 investor 兩邊一開始 agree 咗個 terminal payoff 就得

咁依家 for simplicity 我地剩係討論上面幅圖嘅payoff嘅exchange call option

其餘情況其實都好類似 好容易就generalize到上去 我就唔特別分開再做

(p.s. 其實係因為我懶

)

)

----------------------------------------------

(iii) Purpose

買呢啲 option 嘅目的其實黎黎去去都係嗰啲

多數唔係 hedging 就係 speculation

而因為 exchange call option 嘅 payoff 其實算係食緊兩隻 stock 嘅 price difference

所以一個好合理嘅做法就係如果你speculate緊/backtest到 兩隻stock有 -ve correlation

咁好自然under你嘅assumption/backtest result 兩個stock price 通常都會反向咁走

exchange call option就可以幫你將呢個關係轉化做 $$$

又或者你本身已經 hold 住咗 stock 2

因為某啲原因你唔想再 hold 譬如你覺得佢已經升到冇得再升

而同時你又覺得stock 1買得過 咁exchange call option就幫到你

----------------------------------------------

(iv) Pricing

其實上面都講到出腸 大家都應該估到我想做啲乜

拎得嚟做 underlyings 嘅兩隻 stock 冇乜可能冇correlation

就算真係冇 學識咗 Cholesky decomposition 之後

我地依家都已經有能力consider一個有correlation嘅general case

所以點都當咗有correlation先 你好肯定佢地冇嗰時再set ρ = 0

你好肯定佢地冇嗰時再set ρ = 0

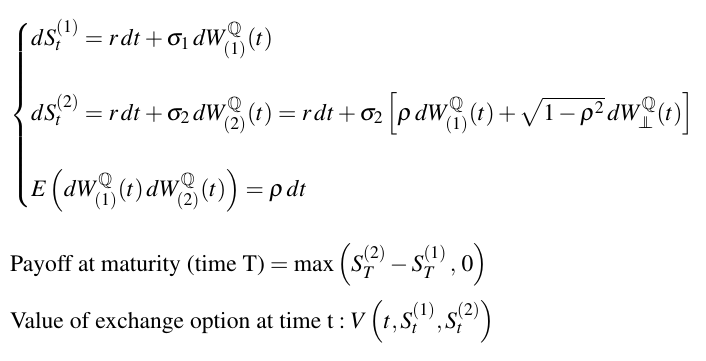

下面就係我地依家嘅setting

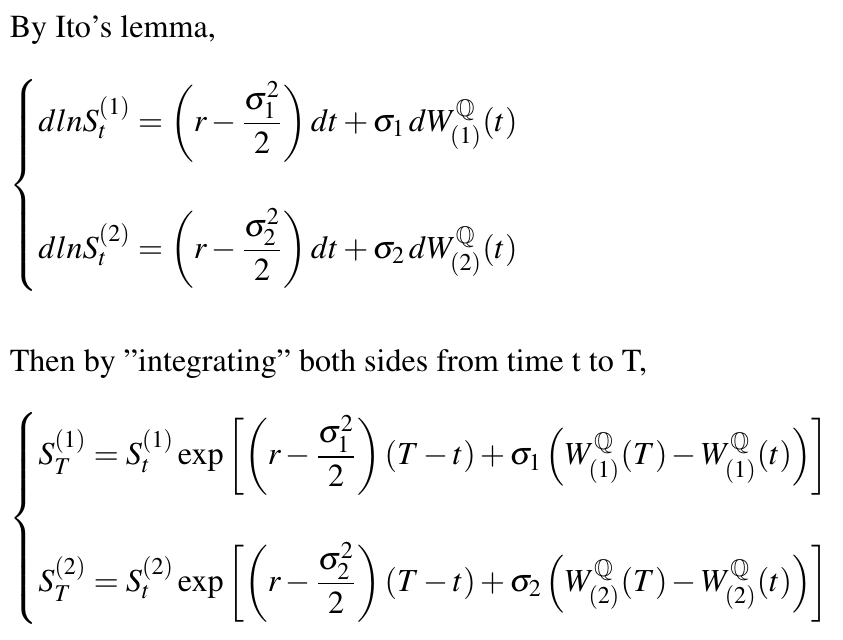

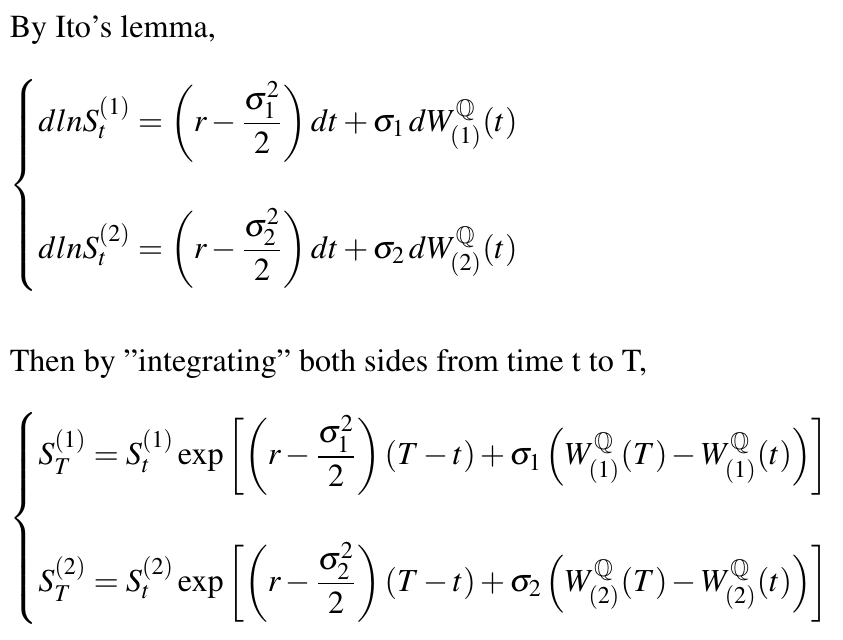

希望大家仲記得 GBM solve 完之後係咩樣

唔記得唔緊要 我寫多一次當係reference 之後睇得舒服啲

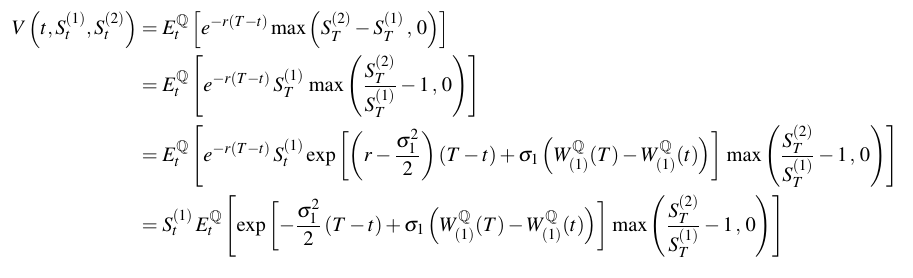

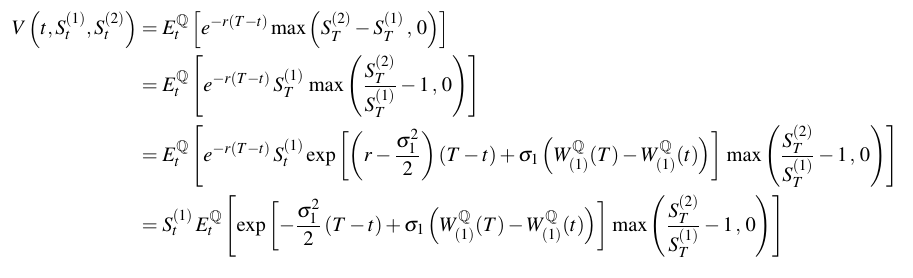

跟住其實都係 risk-neutral valuation 同 Girsanov Theorem

去圖

去圖

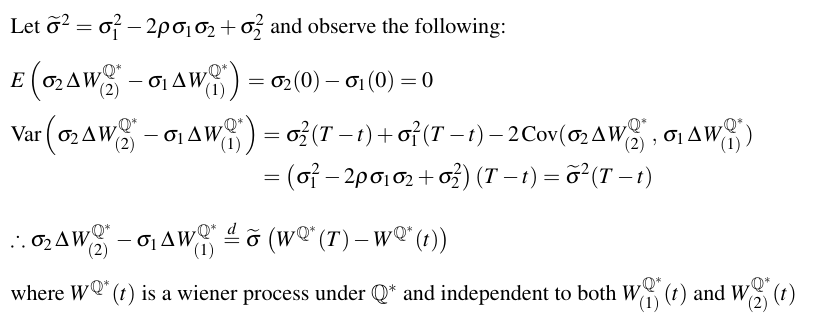

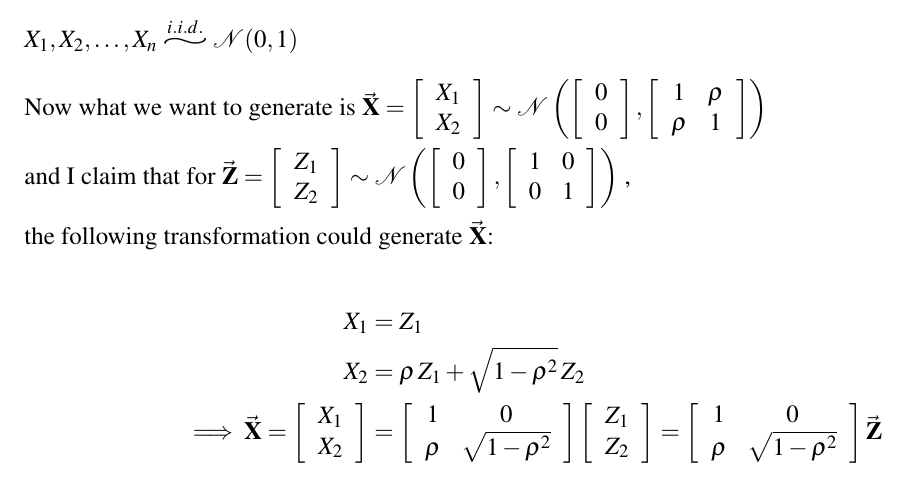

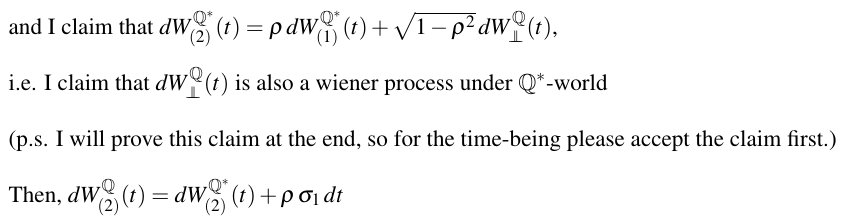

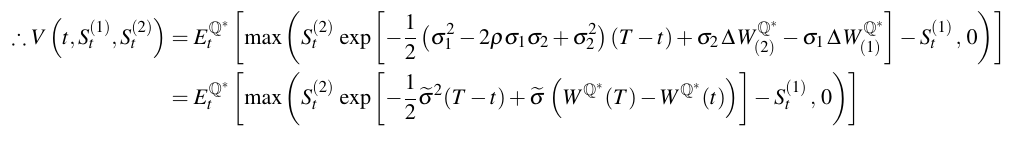

做到呢個位 有舊exp(...)喺expectation入面

個form又咁正路 所以又係時候用Girsanov Theorem

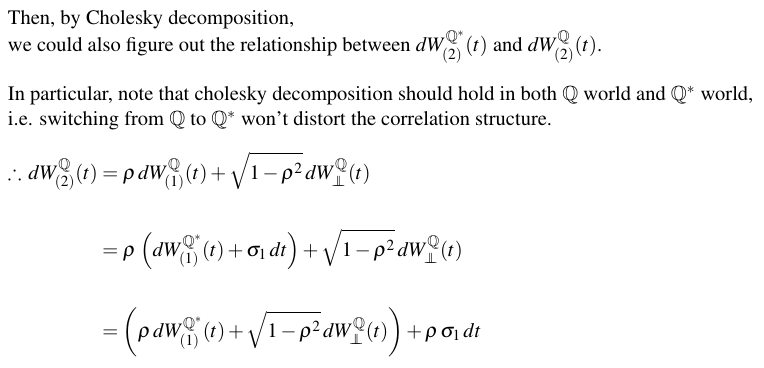

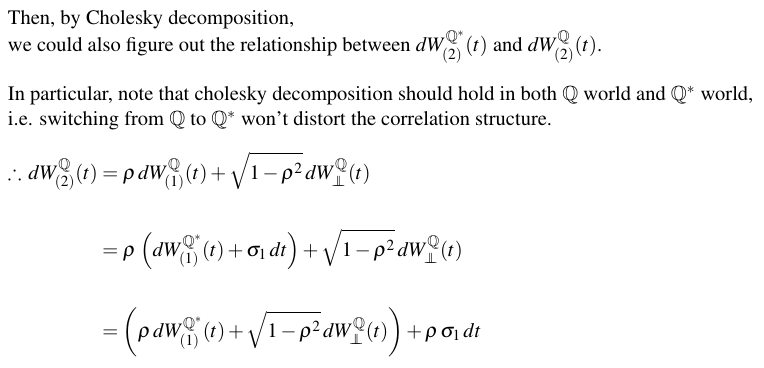

然後再透過 Cholesky decomposition

我地亦都可以知道埋 dW2(t) 喺 Q-world 同 Q*-world 之間嘅關係

然後貌似就好似卡死咗咁 括號入面一個Q一個Q*又好似唔可以再化簡

括號入面一個Q一個Q*又好似唔可以再化簡

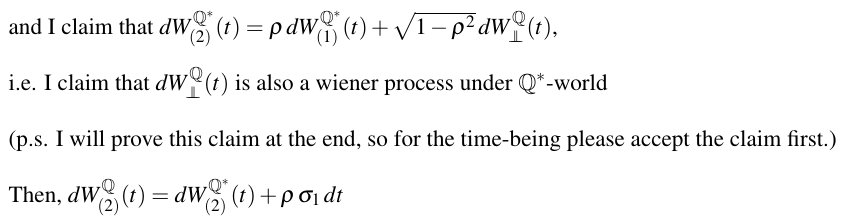

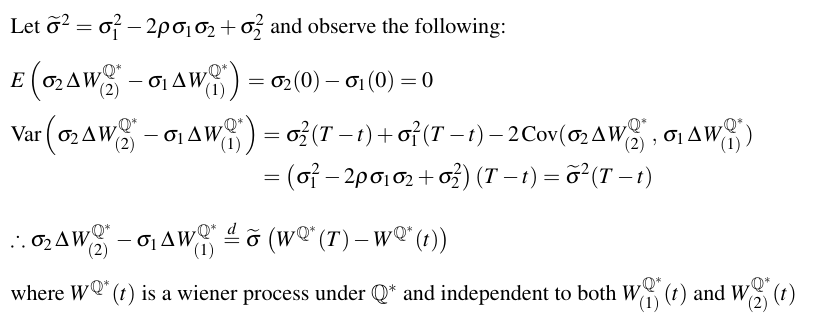

其實我地並冇卡死 只係我需要大家accept咗一啲嘢先

我寫得出呢個claim就肯定係啱嘅

至於點解啱我就留到最後先講 因為原因都比較technical 有興趣嘅讀者可以碌到最尾望下

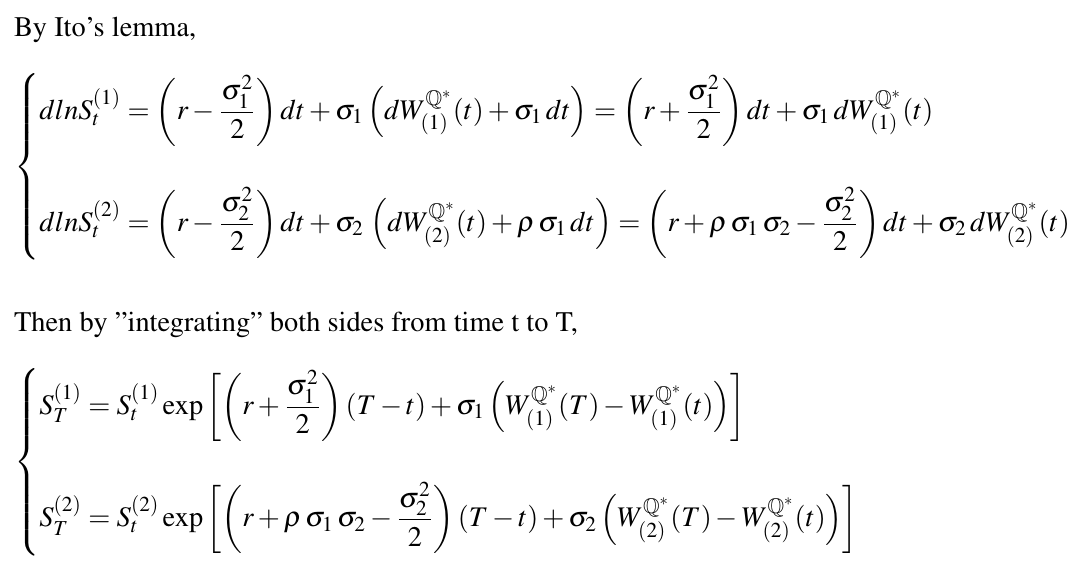

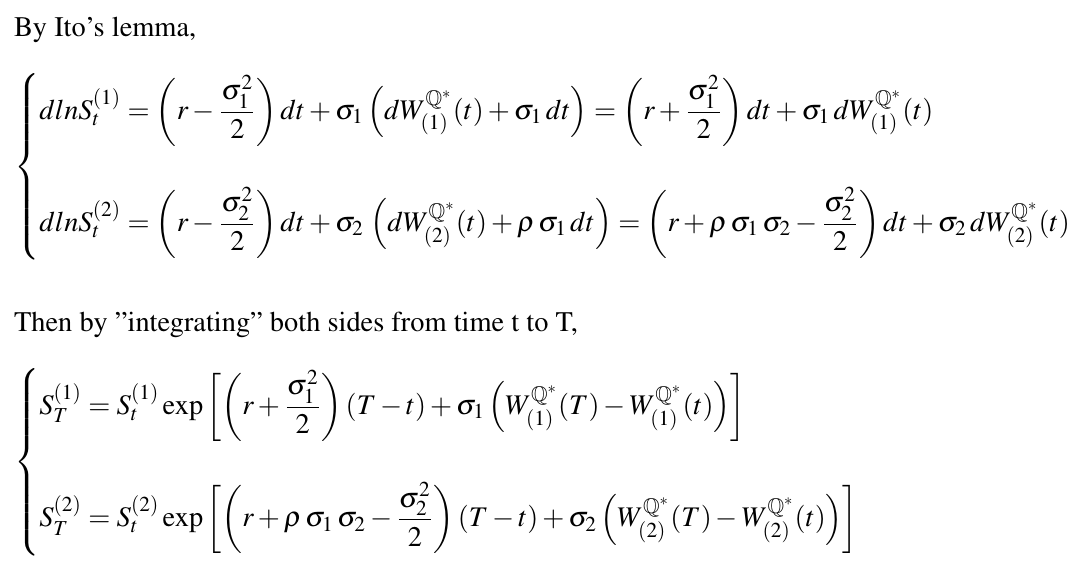

咁依家我地有齊 dW1(t) 同 dW2(t) 喺 Q-world 同 Q*-world 嘅關係

順便就可以揾埋 S1 同 S2 喺 Q*-world 嘅 dynamics

其實我地無論如何都喺要知佢地喺 Q*-world 嘅SDE係點樣

因為用完 Girsanov Theorem 之後 個expectation已經taken under Q*

所以如果我地仲繼續用 under Q-world 嘅 dynamics 就會計錯數 (因為個mean已經shift咗)

而下圖就係S1 同 S2 喺 Q*-world 嘅 dynamics

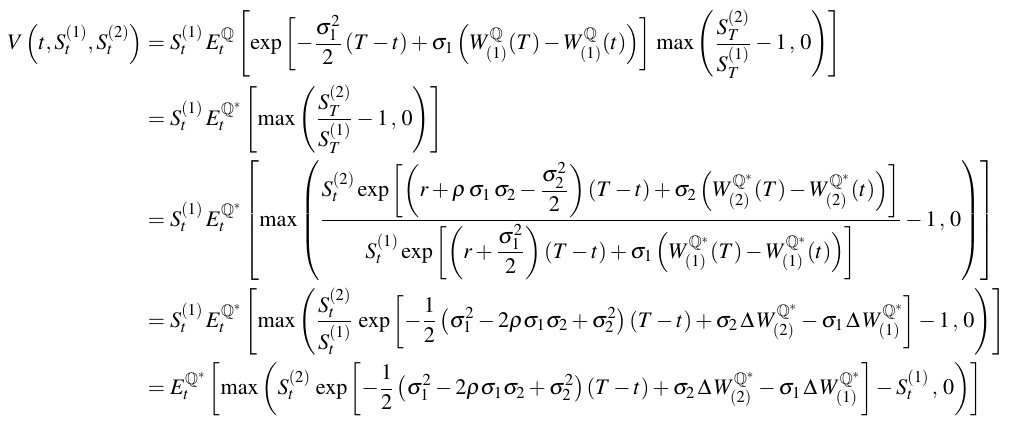

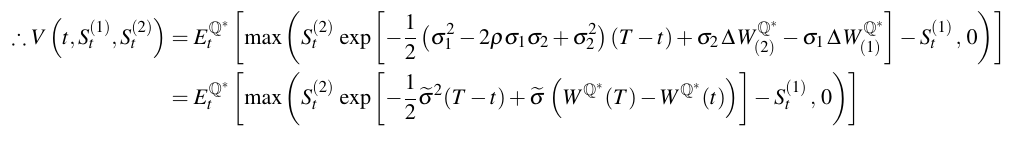

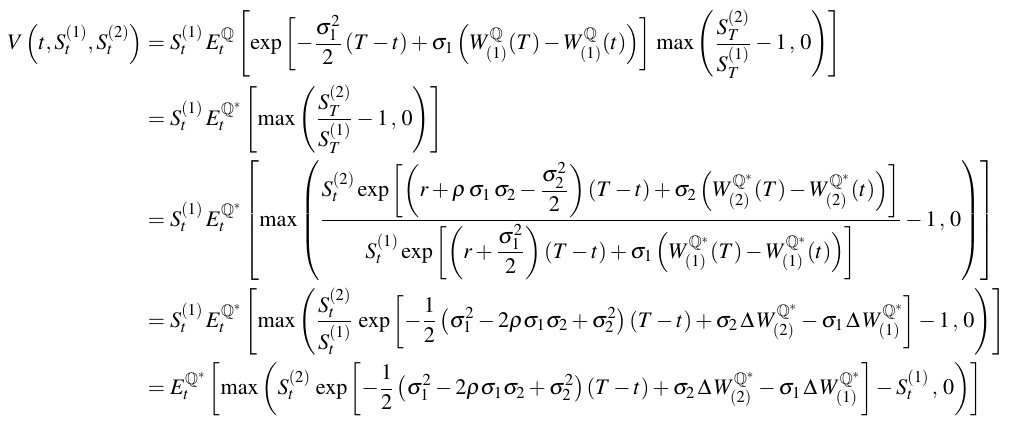

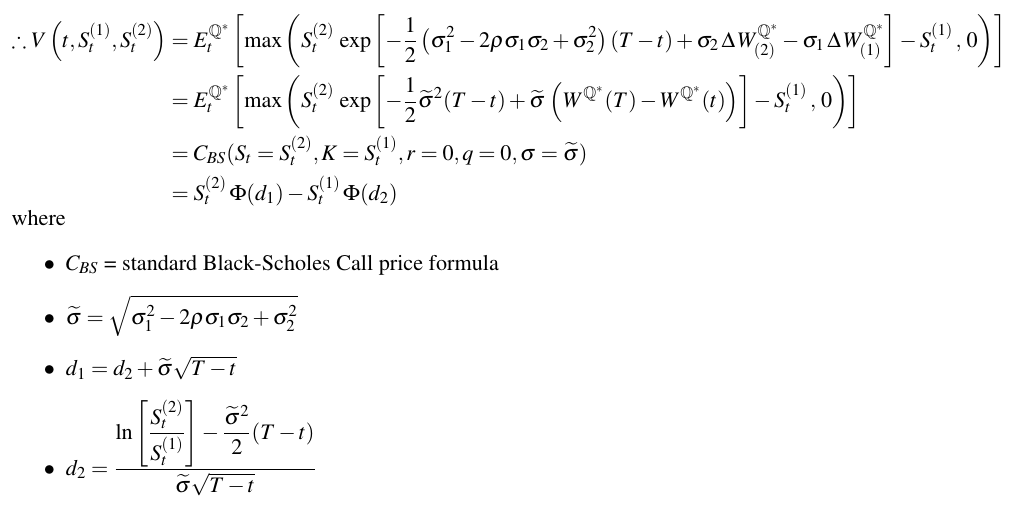

我地搞完一大輪終於可以繼續計粒 V(t,S1(t),S2(t))

眼力好又心算好嘅朋友可能已經睇到神奇嘅地方喺邊

我地就再繼續做落去啦

大家應該都發現 做到最尾其實同bond option嘅做法愈黎愈似

寫埋尾二嗰一步大家就可以睇到其實真係非常之似

所以我地亦都可以好似做bond option嗰時咁

用Black Scholes Call price formula 嘅 form去寫低 V(t,S1(t),S2(t))

點解呢個寫法valid我喺#500已經解釋過 如果有唔明可以去睇下先

打咗差唔多4000字

最尾都係去返Black Scholes call price formula

This is the beauty of option pricing

----------------------------------------------

(v) 下回提要

European call price under Black Scholes model with stochastic interest rate

e.g. Exchange option

(i) Background review

考曬midterm之後又可以繼續出post

首先review一次 Cholesky decomposition 先 跟住就可以講 exchange option

上次最尾我地講到可以用下面幅圖嘅 transformation 去 generate 兩粒 correlated 嘅 bivariate normal R.V.s

而去到 wiener processes 身上

其實個 transformation 都係一模一樣 而呢個做法就係 (2D版) Cholesky Decomposition

(p.s. n dimension版我會留返講 simulation 嗰時先處理 大家唔洗擔心我肯定會講)

咁再將呢個 technique 放落去兩條 GBM 入面就會變咗下圖咁

最尾個結果就係我地將自己心目中嘅 correlation structure 加咗入去呢兩條 SDE 入面

你地應該會問 最尾嗰舊 E(...) = ρdt 係想講乜?

唔緊要 大家可以用一個 好heuristic 嘅方法去諗

所以大家可以當呢句係講緊兩條 wiener processes 嘅 covariance 係 ρdt

亦即係 imply 緊佢地嘅 correlation 就係 ρ

----------------------------------------------

(ii) Structure

Exchange option 最簡單嘅版本應該剩係牽涉兩隻stock 1 同 2

咁同之前一樣我剩係會討論 european exchange call option

呢隻 deriv 喺 maturity (Time T) 嘅 payoff 就係:

如果照字面上理解就係喺maturity嗰時

我地會賣咗 stock 2 同時買返 stock 1

咁話明係call option 如果上面咁樣做我地賺唔到錢自然就唔會exercise呢隻option

而買邊隻賣邊隻其實都係 issuer 同 investor 自己定

甚或乎個payoff可以係賣1手 stock 2 同時買返3手 stock 1 都ok

總之 issuer 同 investor 兩邊一開始 agree 咗個 terminal payoff 就得

咁依家 for simplicity 我地剩係討論上面幅圖嘅payoff嘅exchange call option

其餘情況其實都好類似 好容易就generalize到上去 我就唔特別分開再做

(p.s. 其實係因為我懶

)

)----------------------------------------------

(iii) Purpose

買呢啲 option 嘅目的其實黎黎去去都係嗰啲

多數唔係 hedging 就係 speculation

而因為 exchange call option 嘅 payoff 其實算係食緊兩隻 stock 嘅 price difference

所以一個好合理嘅做法就係如果你speculate緊/backtest到 兩隻stock有 -ve correlation

咁好自然under你嘅assumption/backtest result 兩個stock price 通常都會反向咁走

exchange call option就可以幫你將呢個關係轉化做 $$$

又或者你本身已經 hold 住咗 stock 2

因為某啲原因你唔想再 hold 譬如你覺得佢已經升到冇得再升

而同時你又覺得stock 1買得過 咁exchange call option就幫到你

----------------------------------------------

(iv) Pricing

其實上面都講到出腸 大家都應該估到我想做啲乜

拎得嚟做 underlyings 嘅兩隻 stock 冇乜可能冇correlation

就算真係冇 學識咗 Cholesky decomposition 之後

我地依家都已經有能力consider一個有correlation嘅general case

所以點都當咗有correlation先

你好肯定佢地冇嗰時再set ρ = 0

你好肯定佢地冇嗰時再set ρ = 0下面就係我地依家嘅setting

希望大家仲記得 GBM solve 完之後係咩樣

唔記得唔緊要 我寫多一次當係reference 之後睇得舒服啲

跟住其實都係 risk-neutral valuation 同 Girsanov Theorem

去圖

去圖

做到呢個位 有舊exp(...)喺expectation入面

個form又咁正路 所以又係時候用Girsanov Theorem

然後再透過 Cholesky decomposition

我地亦都可以知道埋 dW2(t) 喺 Q-world 同 Q*-world 之間嘅關係

然後貌似就好似卡死咗咁

括號入面一個Q一個Q*又好似唔可以再化簡

括號入面一個Q一個Q*又好似唔可以再化簡其實我地並冇卡死 只係我需要大家accept咗一啲嘢先

我寫得出呢個claim就肯定係啱嘅

至於點解啱我就留到最後先講 因為原因都比較technical 有興趣嘅讀者可以碌到最尾望下

咁依家我地有齊 dW1(t) 同 dW2(t) 喺 Q-world 同 Q*-world 嘅關係

順便就可以揾埋 S1 同 S2 喺 Q*-world 嘅 dynamics

其實我地無論如何都喺要知佢地喺 Q*-world 嘅SDE係點樣

因為用完 Girsanov Theorem 之後 個expectation已經taken under Q*

所以如果我地仲繼續用 under Q-world 嘅 dynamics 就會計錯數 (因為個mean已經shift咗)

而下圖就係S1 同 S2 喺 Q*-world 嘅 dynamics

我地搞完一大輪終於可以繼續計粒 V(t,S1(t),S2(t))

眼力好又心算好嘅朋友可能已經睇到神奇嘅地方喺邊

我地就再繼續做落去啦

大家應該都發現 做到最尾其實同bond option嘅做法愈黎愈似

寫埋尾二嗰一步大家就可以睇到其實真係非常之似

所以我地亦都可以好似做bond option嗰時咁

用Black Scholes Call price formula 嘅 form去寫低 V(t,S1(t),S2(t))

點解呢個寫法valid我喺#500已經解釋過 如果有唔明可以去睇下先

打咗差唔多4000字

最尾都係去返Black Scholes call price formula

This is the beauty of option pricing

----------------------------------------------

(v) 下回提要

European call price under Black Scholes model with stochastic interest rate

Stochastic interest rate range

推一推支持下樓主

希望有機會可以睇曬

希望有機會可以睇曬

多謝各位

喺度同聽日考4001嘅人講聲加油

喺度同聽日考4001嘅人講聲加油

stochastic interest rate 係咪姐係個堆short term model, HJM??

係的話等你救命

係的話等你救命

應該有排先講到short rate model

依家stochastic interest rate我只係考慮緊最basic嘅Vasicek model

hull white model cir model嗰堆短期內唔會講住

因為我想由build yield curve開始講起 咁樣個flow會連貫啲

依家用Vasicek model你當係過下手癮

其實好老實講 fixed income我都唔係話好有信心可以講得好

包埋credit risk要整dual/multi curve就更加複雜

同埋fixed income嘅content已經足夠額外開多個post講

睇下呢度有冇高手得閒肯出招

依家stochastic interest rate我只係考慮緊最basic嘅Vasicek model

hull white model cir model嗰堆短期內唔會講住

因為我想由build yield curve開始講起 咁樣個flow會連貫啲

依家用Vasicek model你當係過下手癮

其實好老實講 fixed income我都唔係話好有信心可以講得好

包埋credit risk要整dual/multi curve就更加複雜

同埋fixed income嘅content已經足夠額外開多個post講

睇下呢度有冇高手得閒肯出招

留名

啱啱考完exam ifm又有時間寫

我望返上一個cm發現原來打漏咗個proof

應該係爆字數之後唔記得咗打

陣間打埋上黎先

我望返上一個cm發現原來打漏咗個proof

應該係爆字數之後唔記得咗打

陣間打埋上黎先

我篇論文就係要寫short rate model

仲未諗到題目

仲未諗到題目

In my opinion, it is more common to write

dWt dBt = \rho dt

without the expectation as these deferential notations are understood in a L2 sense anyways.

dWt dBt = \rho dt

without the expectation as these deferential notations are understood in a L2 sense anyways.

then I will drop the expectation from now on haha

Thx for the reminder

Thx for the reminder

巴打讀緊mphil/phd?

master姐

個tutor話我可以諗個新model

個tutor話我可以諗個新model

邊間讀緊?

依家做short rate多數都要dual/multi curve setting先有意思

如果唔係你account唔到credit risk 啲price都係錯曬

但係個model就會變到好複雜

諗新model我覺得更加痴線

我諗最傳統嗰兩三個都已經比人explore曬

我諗最傳統嗰兩三個都已經比人explore曬

依家做short rate多數都要dual/multi curve setting先有意思

如果唔係你account唔到credit risk 啲price都係錯曬

但係個model就會變到好複雜

諗新model我覺得更加痴線

我諗最傳統嗰兩三個都已經比人explore曬

我諗最傳統嗰兩三個都已經比人explore曬