IB用家討論區 (9)

下面係摩打

1001 回覆

11 Like

2 Dislike

遲少少可以download 一年報告

你有冇login 過網頁版搵report

set番period就出到晒, 包括收過邊期股息

set番period就出到晒, 包括收過邊期股息

邊間銀行

係咪當左香港tt 過去

係咪當左香港tt 過去

情況似#171

不過人地係提款

你係入款

不過人地係提款

你係入款

請問有冇得set 升到某個位再追某個價,但跌返都有保底

例如15蚊買過咗18蚊之後想追20,但跌咗都止蝕18

例如15蚊買過咗18蚊之後想追20,但跌咗都止蝕18

新手想開戶,楷級式收費同固定式收費你地會點揀?

主要想買港股收息

主要想買港股收息

新手想問下今日係咪做唔到交易同提款?

好似去到NEW YORK下午3點30

我都等緊...好煩

我都等緊...好煩

IB入錢好慢  你地平時存錢要幾耐

你地平時存錢要幾耐

你地平時存錢要幾耐

你地平時存錢要幾耐eDDA 即嗌即用

加拿大移民撚世界未日

Dear Client,

Due to increased restrictions on Canadian dollars ("CAD"), as of January 12th, 2024 deposits and withdrawals of CAD will be limited to CA $10,000 per month.

Please keep in mind that the funds you hold at IBKR benefit from our Strength and Security protections, including our strong capital position, conservative balance sheet and automated risk controls. As of June 30, 2023, Interactive Brokers Group had $365 billion in client equity and more than $9 billion in excess regulatory capital.

Interactive Brokers also pays Market Rate Interest on your instantly available cash balances, currently up to 4.83% on eligible USD balances.

Please note that you may continue converting to Canadian dollars and trading Canadian securities. However, future deposits and withdrawals in excess of CA $10,000 per month must be made in the other currencies supported by Interactive Brokers.

Dear Client,

Due to increased restrictions on Canadian dollars ("CAD"), as of January 12th, 2024 deposits and withdrawals of CAD will be limited to CA $10,000 per month.

Please keep in mind that the funds you hold at IBKR benefit from our Strength and Security protections, including our strong capital position, conservative balance sheet and automated risk controls. As of June 30, 2023, Interactive Brokers Group had $365 billion in client equity and more than $9 billion in excess regulatory capital.

Interactive Brokers also pays Market Rate Interest on your instantly available cash balances, currently up to 4.83% on eligible USD balances.

Please note that you may continue converting to Canadian dollars and trading Canadian securities. However, future deposits and withdrawals in excess of CA $10,000 per month must be made in the other currencies supported by Interactive Brokers.

想問吓IB買基金係咪都係免手續費?

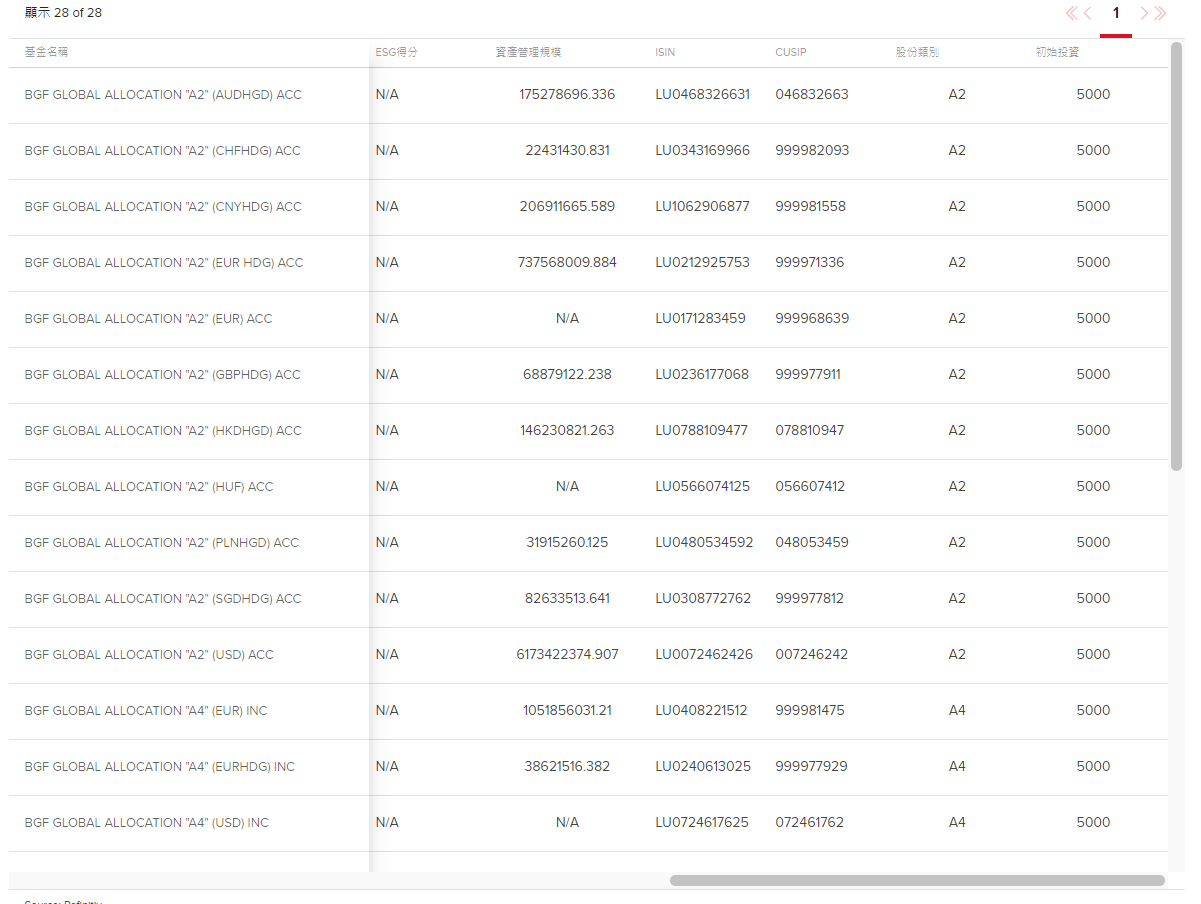

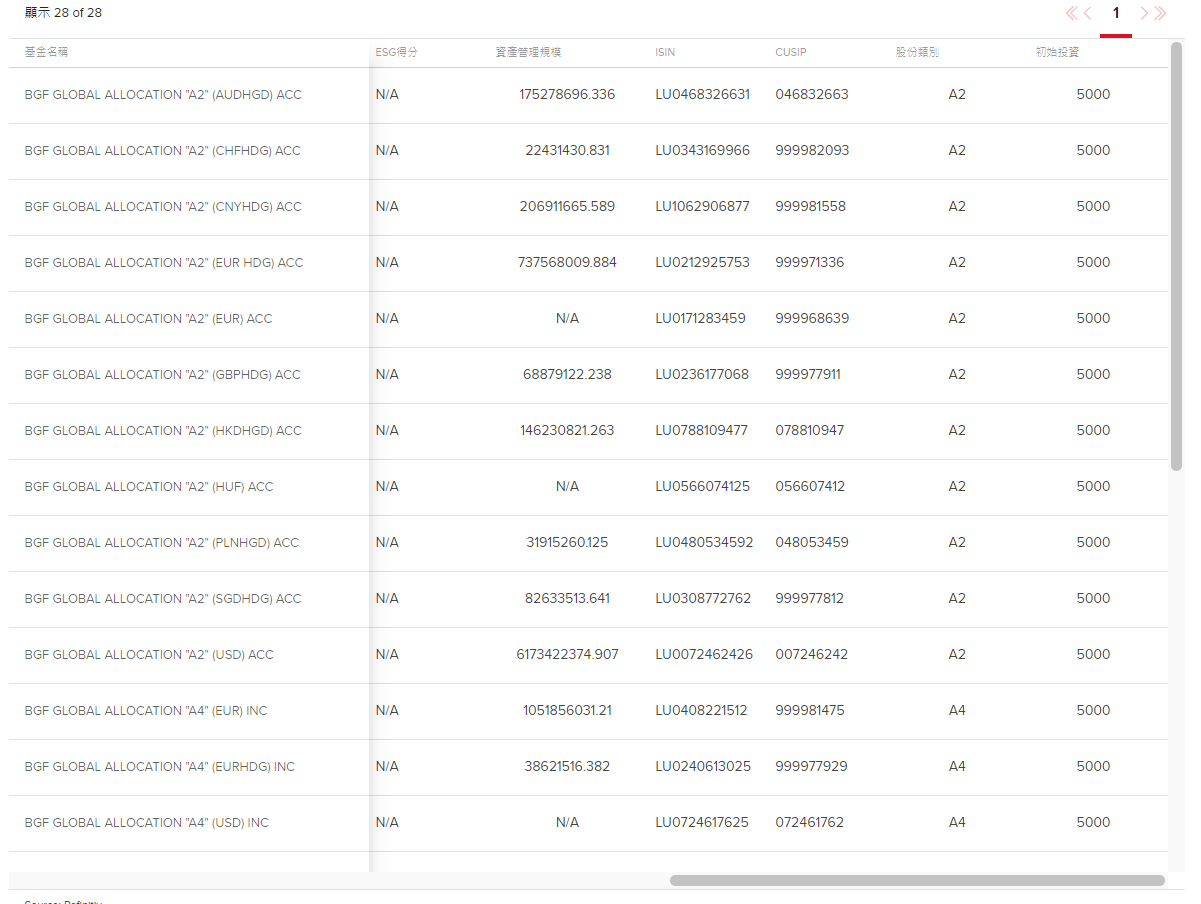

呢個表個意思係第一次買要入場5000HKD定5000股?

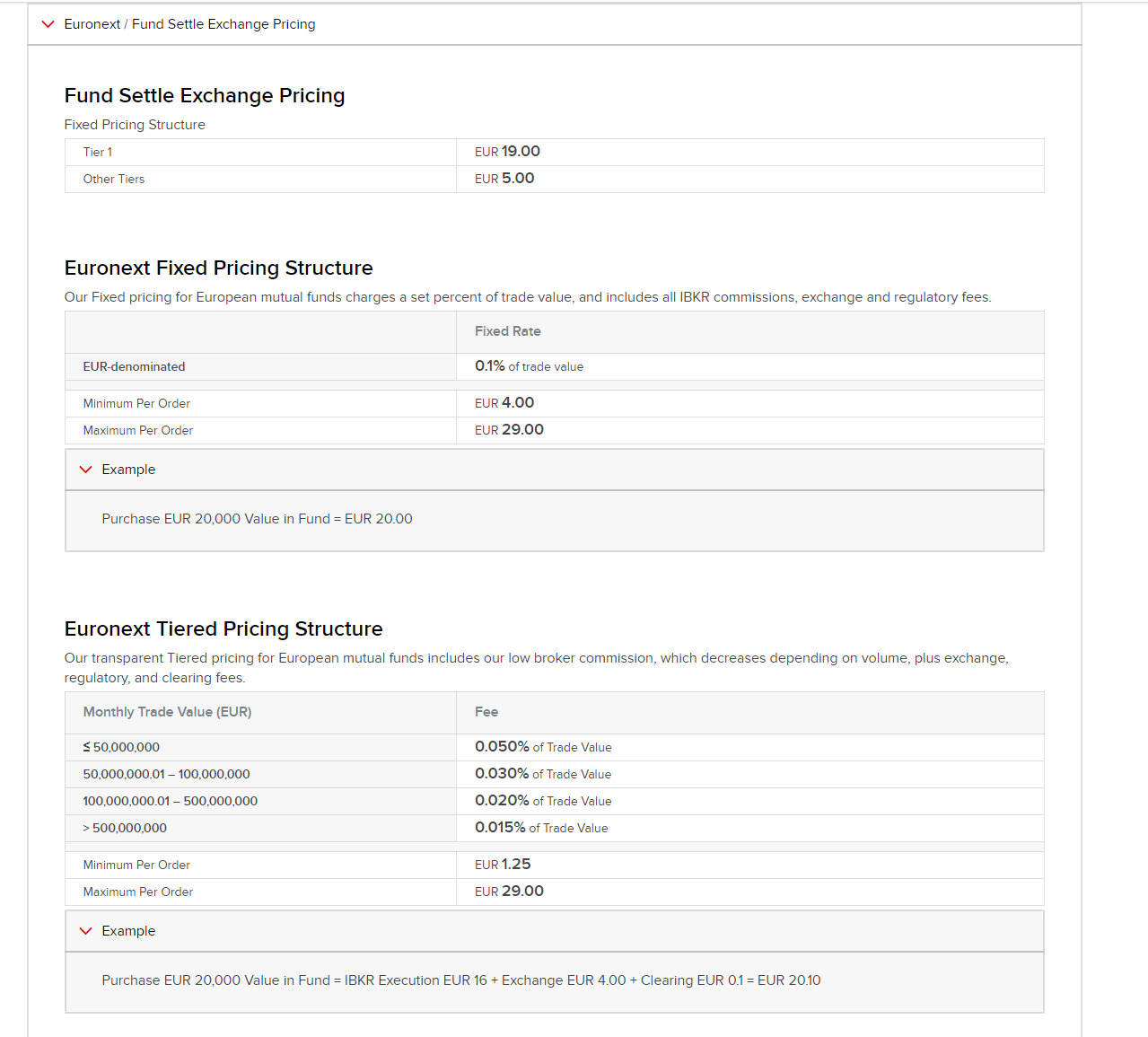

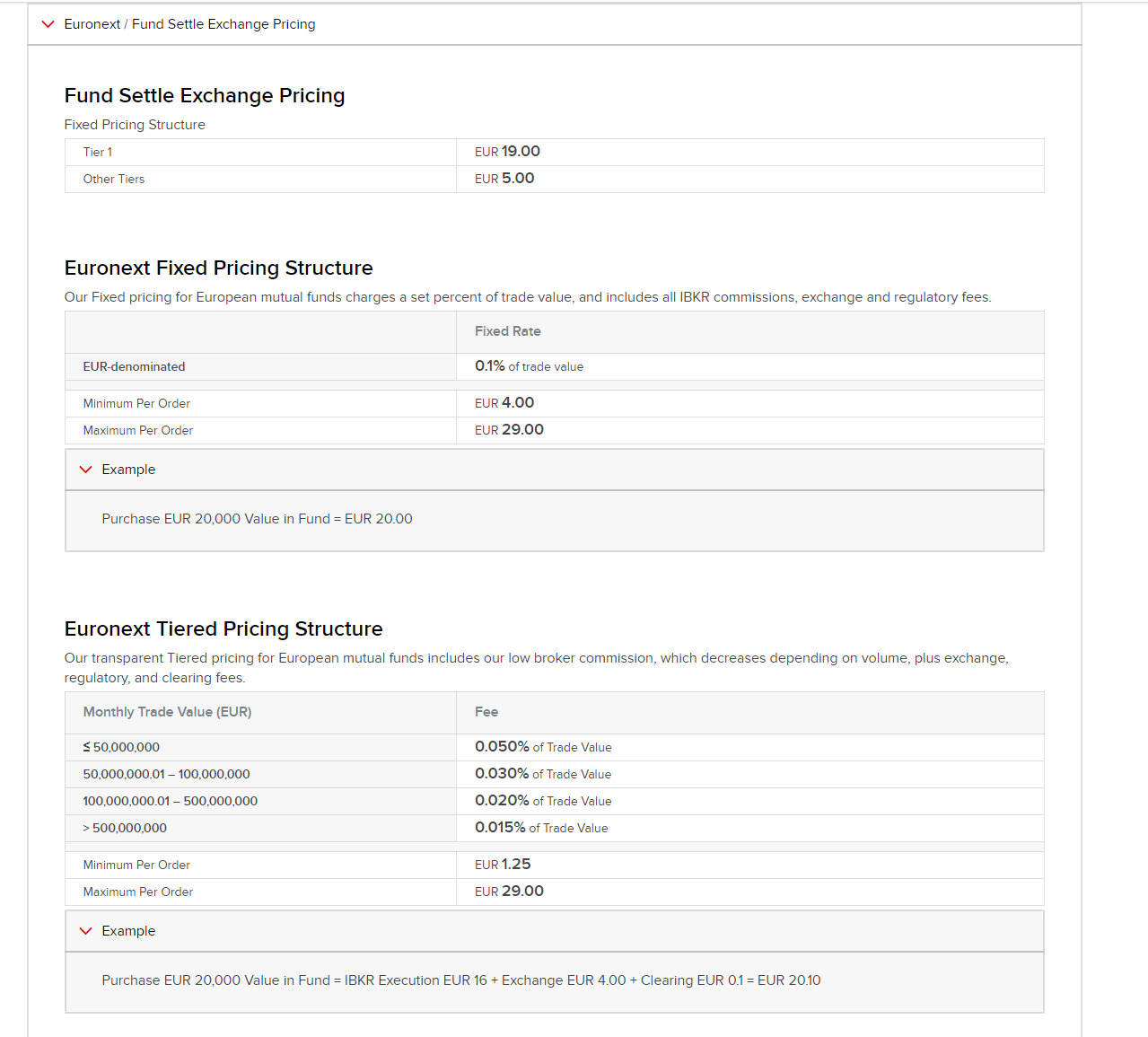

同埋

euronext個settle fee & fixed/tier pricing structure 係咪apply to all funds?

呢個表個意思係第一次買要入場5000HKD定5000股?

同埋

euronext個settle fee & fixed/tier pricing structure 係咪apply to all funds?

用轉數快入金係咪要等48小時...

我都收到之前重以為個别,我都係換過幾次幾萬蚊加紙,户口另有放美元都玩限制

Management fee 係包埋係performance入面

咩事有restriction

可能同加拿大既anti money laundering監管機構 (“FINTRAC”) 新收費有關。

https://www.dlapiper.com/en/insights/publications/2023/10/fintrac-issues-new-guidance

Expense funding model

Beginning on April 1, 2024, FINTRAC will finance its compliance monitoring program by charging an annual cost to:

federally regulated banks, trust and loan, and insurance companies; and other reporting entities that submit 500 or more threshold transaction reports (transactions of $10,000 or more) during the fiscal year.

The annual cost will be determined based on a formula whereby the amount charged to the Reporting Entity will vary based on, the type of entity, the value of Canadian assets it holds, the total actual cost of FINTRAC’s compliance program, and the number of reported threshold transactions.

Previously, FINTRAC’s compliance monitoring program was entirely financed by the federal government. Under the new expense funding model the burden of regulating financial transactions in Canada will shift from the taxpayer, to those entities which are the subject of the monitoring program.

https://www.dlapiper.com/en/insights/publications/2023/10/fintrac-issues-new-guidance

Expense funding model

Beginning on April 1, 2024, FINTRAC will finance its compliance monitoring program by charging an annual cost to:

federally regulated banks, trust and loan, and insurance companies; and other reporting entities that submit 500 or more threshold transaction reports (transactions of $10,000 or more) during the fiscal year.

The annual cost will be determined based on a formula whereby the amount charged to the Reporting Entity will vary based on, the type of entity, the value of Canadian assets it holds, the total actual cost of FINTRAC’s compliance program, and the number of reported threshold transactions.

Previously, FINTRAC’s compliance monitoring program was entirely financed by the federal government. Under the new expense funding model the burden of regulating financial transactions in Canada will shift from the taxpayer, to those entities which are the subject of the monitoring program.

係咪曾經換過CAD先限制?我個AC換過幾萬有收到email,屋企人冇換過收唔到。

咁就大鑊,仲有好多做緊HKD定期要去到5月先有得換

咁就大鑊,仲有好多做緊HKD定期要去到5月先有得換