多倫多生活討論區 111 一 祝聖誕同新年快樂-執齊啲嘢準備報稅啦!

CNTower

1001 回覆

8 Like

8 Dislike

個人基本入息稅用唔晒可以畀另一半用,rrsp, fhsa嗰啲扣稅只可以自用。

Do you or your boy friend has any income from outside Canada since the day you both entered Canada?

Did you or your boy friend received MPF from Hong Kong? if yes, then when?

Do you or your boy friend has any assets outside Canada when both of you entered Canada? Assets include investments, house etc.

Check this out if you are considering filing single or common law

https://www.wealthsimple.com/en-ca/learn/married-common-law-tax

How marriage and common-law unions change your tax status in Canada

By The Editors

Updated December 20, 2024

When you get married, or start living together under a common-law arrangement, it can impact your tax situation. Some of the changes occur immediately (e.g., your eligibility for the GST/HST credit) and other changes impact you when you file your tax return. One thing that doesn’t change, however, is that you are both still required to file your own tax returns.

While it’s obvious that your marital status changes when you get married, many people are surprised to find out that for tax purposes, they’re already living common-law. Under the Income Tax Act, your marital status changes to common-law when you’ve been living with your significant other for 12 months or more. Other situations that classify as a common-law arrangement include living with the person you share a child with, either as a birth parent or under a custodial agreement.

What happens when your marital status changes

Here are some things to be aware of when your relationship status changes:

Your entitlement to the GST/HST credit changes since it is based on “adjusted family net income.” If your partner earns income, your adjusted family net income usually increases when you become married or common-law, so you might find that you no longer receive the GST/HST credit. If you are still eligible for the credit, only one of you will receive it, even if you were both receiving it before.

Your entitlement to the CCB and CWB changes, respectively, since these are also based on your adjusted family net income

When you’re completing your tax return, you’ll need to provide information about your spouse or common-law partner, including his or her net income, for certain credits to calculate properly

If you or your partner’s net income (line 23600) is less than $15,705 (2024 number), the other person will get a tax credit called the spouse or common-law partner amount. Be aware that the other spouse’s net income must be less than the claiming spouses basic personal amount. If the claiming spouse’s income is greater than $173,205, this amount can go as low as $14,156 for 2024 (see Federal Worksheet). If your spouse is impaired, this amount is increased. The claiming spouse must also be supporting the transferring spouse.

You can split or share certain credits. For example, if you both have medical expenses, one of you can claim them all to increase your refund. Wealthsimple Tax will automatically optimize your returns to take advantage of this.

Whether your partner owns or has previously owned a home can impact your eligibility for the home buyers’ plan and home buyers’ amount

You can withdraw funds under the Lifelong Learning Plan from your Registered Retirement Savings Plan (RRSP) for your partner to go back to school

If you are both supporting your children, the lower-income partner usually claims child care expenses. However, there are some conditions in which the higher-income party claims expenses.

The higher-income person can contribute to a spousal RRSP, effectively splitting income if you and your partner are in different tax brackets

It’s important to let the Canada Revenue Agency know when your marital status changes. You can do this through My Account, by phone, or by filing form RC65. You must also accurately report your marital status when filing your tax return — even if you don’t really feel like you’re living common-law.

Did you or your boy friend received MPF from Hong Kong? if yes, then when?

Do you or your boy friend has any assets outside Canada when both of you entered Canada? Assets include investments, house etc.

Check this out if you are considering filing single or common law

https://www.wealthsimple.com/en-ca/learn/married-common-law-tax

How marriage and common-law unions change your tax status in Canada

By The Editors

Updated December 20, 2024

When you get married, or start living together under a common-law arrangement, it can impact your tax situation. Some of the changes occur immediately (e.g., your eligibility for the GST/HST credit) and other changes impact you when you file your tax return. One thing that doesn’t change, however, is that you are both still required to file your own tax returns.

While it’s obvious that your marital status changes when you get married, many people are surprised to find out that for tax purposes, they’re already living common-law. Under the Income Tax Act, your marital status changes to common-law when you’ve been living with your significant other for 12 months or more. Other situations that classify as a common-law arrangement include living with the person you share a child with, either as a birth parent or under a custodial agreement.

What happens when your marital status changes

Here are some things to be aware of when your relationship status changes:

Your entitlement to the GST/HST credit changes since it is based on “adjusted family net income.” If your partner earns income, your adjusted family net income usually increases when you become married or common-law, so you might find that you no longer receive the GST/HST credit. If you are still eligible for the credit, only one of you will receive it, even if you were both receiving it before.

Your entitlement to the CCB and CWB changes, respectively, since these are also based on your adjusted family net income

When you’re completing your tax return, you’ll need to provide information about your spouse or common-law partner, including his or her net income, for certain credits to calculate properly

If you or your partner’s net income (line 23600) is less than $15,705 (2024 number), the other person will get a tax credit called the spouse or common-law partner amount. Be aware that the other spouse’s net income must be less than the claiming spouses basic personal amount. If the claiming spouse’s income is greater than $173,205, this amount can go as low as $14,156 for 2024 (see Federal Worksheet). If your spouse is impaired, this amount is increased. The claiming spouse must also be supporting the transferring spouse.

You can split or share certain credits. For example, if you both have medical expenses, one of you can claim them all to increase your refund. Wealthsimple Tax will automatically optimize your returns to take advantage of this.

Whether your partner owns or has previously owned a home can impact your eligibility for the home buyers’ plan and home buyers’ amount

You can withdraw funds under the Lifelong Learning Plan from your Registered Retirement Savings Plan (RRSP) for your partner to go back to school

If you are both supporting your children, the lower-income partner usually claims child care expenses. However, there are some conditions in which the higher-income party claims expenses.

The higher-income person can contribute to a spousal RRSP, effectively splitting income if you and your partner are in different tax brackets

It’s important to let the Canada Revenue Agency know when your marital status changes. You can do this through My Account, by phone, or by filing form RC65. You must also accurately report your marital status when filing your tax return — even if you don’t really feel like you’re living common-law.

都唔一定。 不過好多當選既都係靠個黨推上位。

想問我上年返香港果時

屋企人比左兩三萬HKD cash我

我再入番自己銀行

呢D洗唔洗報稅

屋企人比左兩三萬HKD cash我

我再入番自己銀行

呢D洗唔洗報稅

No

Keep all documents to prove the source of funds

Keep all documents to prove the source of funds

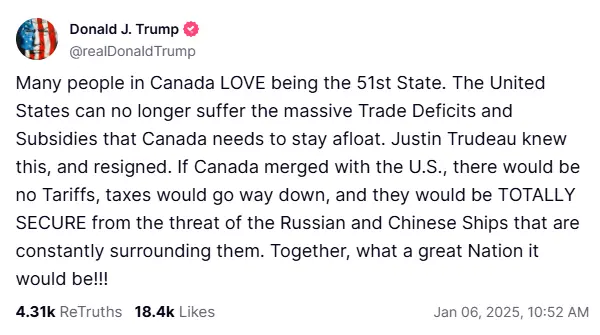

Oh Canada變O say can you see

如果加拿大係一個州

多數會係一個左傾嘅州

人口同加州咁上下

即係會多咗50幾張左票

有共和黨著數咩?

多數會係一個左傾嘅州

人口同加州咁上下

即係會多咗50幾張左票

有共和黨著數咩?

美國海外領土都做唔到啦,聽佢9up

唔係加拿大肯唔肯併入美國,係美國肯唔肯要加拿大

仲有冇free health care

soundbite

soundbitetwitter治國

都做左兩屆啦

又冇得連任

點都要係歷史留名

雖然都係9up多

不過上兵伐謀

未上任出個post

就收左Trudeau皮

好過香港啲官

淨係識黨八股

講左當做左

又冇得連任

點都要係歷史留名

雖然都係9up多

不過上兵伐謀

未上任出個post

就收左Trudeau皮

好過香港啲官

淨係識黨八股

講左當做左

關咩事吖

方小姐先係最後一根稻草

方小姐先係最後一根稻草

我擔心大學多啲

加拿大大學學費同美國比平咁多

加拿大大學學費同美國比平咁多

唔好睇到佢9up 咁大效用,係連個最高民望既財長都跳船先逼死道友多

但樓下好咁多

性價比高喎 啱曬嗰啲成績唔錯但又未叻到有獎學金嘅人

下面好嗰啲 幾乎全部私立 唔係一般人負擔得起

下面好嗰啲 幾乎全部私立 唔係一般人負擔得起

點會唔關事

佢冇威脅加tariff

方小姐都唔會跳船

佢冇威脅加tariff

方小姐都唔會跳船

下面都有好既state school eg uc system

我哋境外冇任何income/資產,mpf係入境前拎。

因為佢2024 入境後income得加拿大銀行利息個幾百蚊,所以如果我用common law形式報稅,我可以用盡佢嗰$15705 crdit嚟減少我嘅入息稅?

因為佢2024 入境後income得加拿大銀行利息個幾百蚊,所以如果我用common law形式報稅,我可以用盡佢嗰$15705 crdit嚟減少我嘅入息稅?

T1 are filed individually whether you are married/common law.

You can not use his personal exemption.

You can not use his personal exemption.

我睇上面篇文寫 If you or your partner’s net income (line 23600) is less than $15,705 (2024 number), the other person will get a tax credit called the spouse or common-law partner amount.

定係我誤會咗

定係我誤會咗