多謝巴打你熱心討論先,首先,我嘅意思唔係話一定183日就唔洗睇DTA

remuneration derived by a

resident of a Contracting Party in respect of an employment exercised in the other

Contracting Party shall be taxable only in the first-mentioned Party if:

(a) the recipient is present in the other Party for a period or periods not

exceeding in the aggregate 183 days in any twelve-month period

commencing or ending in the taxable period concerned, and

(b) the remuneration is paid by, or on behalf of, an employer who is not a

resident of the other Party, and

(c) the remuneration is not borne by a permanent establishment which the

employer has in the other Party, and

(d) the remuneration is taxable in the first-mentioned Party according to

the laws in force in that Party.

主要係因為個問題係講緊一份香港公司出糧嘅HK employment,已經中到B 同C如果由香港呢面睇,巴打只要唔會留UK 超過183日,咁香港就可以有taxing right,而又咁岩要交英國稅,呢個情況DTA先有用,因為可以用DTA去免咗個UK tax。但如果用英國果面睇,因為點都中唔到B 同C, 所以就算你交咗英國稅,都唔可以用DTA嘅方法去免咗個香港稅,呢個時間就會睇Tax claim credit

我17樓覆緊就係睇緊其中一個statutory residence tax, 我明如果你以前曾經係UK tax residence 會有影響,or 你only home is in UK,咁你30days in UK都要交英國稅,有啲Case係會再complicated 啲要睇sufficient ties test。但一般香港人過去,你都係HK UK 兩頭住家,所以好少考慮only home in UK 呢個問題

我明可能我答得太簡單化成件事,但有限嘅時間要覆到咁多post要每個post都detail真係唔太可能,所以我都會以一般情況去講。我appreciate 有巴打會覺得呢個講法唔夠detail,可以再深入啲去傾,咁樣對成個community 都有幫助,但一黎就就單單打打又唔係肯教人嘅態度我就好反感,所以我上面先會咁樣嘈。

執業會計師,公司個人會計報稅問題,你問我答 (4)

雞胸飯走汁

564 回覆

18 Like

2 Dislike

唔洗咁勞氣既,樓上做tax既朋友都係指出一啲practical 既問題/high level咁講有啲咩要注意,咁樓主你開post想幫人解答tax問題,其他人唔會hijack咗你個post既,同埋都要尊重人地想唔想分享更多既。我自己都未敢advise人點樣處理英國/香港個人稅務問題,因為我唔係做individual tax,我只係讀過下。樓上巴打都話冇做individual tax好耐,佢都係戴個頭盔啫。

況且稅務問題唔係千篇一律,我會建議你唔好咁 general,要寫好assumptions/conditions,好多人識表面既野,實際點做係唔知 eg 點樣去同稅局claim 唔洗交salaries tax or 點樣同外國稅局claim tax credit or 點樣避免double tax or evasion of tax…

有時候講得複雜啲 or講d jargon 出黎係無可避免,等如醫生唔會唔用醫療術語,咁樣就令到tax advice唔可以三兩句就講完

況且稅務問題唔係千篇一律,我會建議你唔好咁 general,要寫好assumptions/conditions,好多人識表面既野,實際點做係唔知 eg 點樣去同稅局claim 唔洗交salaries tax or 點樣同外國稅局claim tax credit or 點樣避免double tax or evasion of tax…

有時候講得複雜啲 or講d jargon 出黎係無可避免,等如醫生唔會唔用醫療術語,咁樣就令到tax advice唔可以三兩句就講完

我上幾個post都好歡迎大家幫手一傾一齊答呀 最好你騎刧埋個post我唔洗覆tim,上幾個post一直有幾位巴打好熱心幫手覆問題,好多謝佢哋

最好你騎刧埋個post我唔洗覆tim,上幾個post一直有幾位巴打好熱心幫手覆問題,好多謝佢哋

我係睇唔過眼啲講到自己好有料,但又唔教人,又要用埋啲單單打打態度嘅人姐。尊重就互相嘅,人哋唔尊重我嘅同時我都唔會尊重佢。

明白架啦,我下次呢啲覆得小心啲啦

最好你騎刧埋個post我唔洗覆tim,上幾個post一直有幾位巴打好熱心幫手覆問題,好多謝佢哋

最好你騎刧埋個post我唔洗覆tim,上幾個post一直有幾位巴打好熱心幫手覆問題,好多謝佢哋

我係睇唔過眼啲講到自己好有料,但又唔教人,又要用埋啲單單打打態度嘅人姐。尊重就互相嘅,人哋唔尊重我嘅同時我都唔會尊重佢。

明白架啦,我下次呢啲覆得小心啲啦

同埋呢度討論我覺得盡量唔好用咁多術語,Law section 幾多幾多,jargon呢啲 ,因為個target audience 始終都係一啲冇Accounting or tax knowledge 嘅ching,如果唔係嘅你自己同公司啲同事傾都可以啦

,因為個target audience 始終都係一啲冇Accounting or tax knowledge 嘅ching,如果唔係嘅你自己同公司啲同事傾都可以啦

真係明嘅,白話都講得人明嘅

,因為個target audience 始終都係一啲冇Accounting or tax knowledge 嘅ching,如果唔係嘅你自己同公司啲同事傾都可以啦

,因為個target audience 始終都係一啲冇Accounting or tax knowledge 嘅ching,如果唔係嘅你自己同公司啲同事傾都可以啦

真係明嘅,白話都講得人明嘅

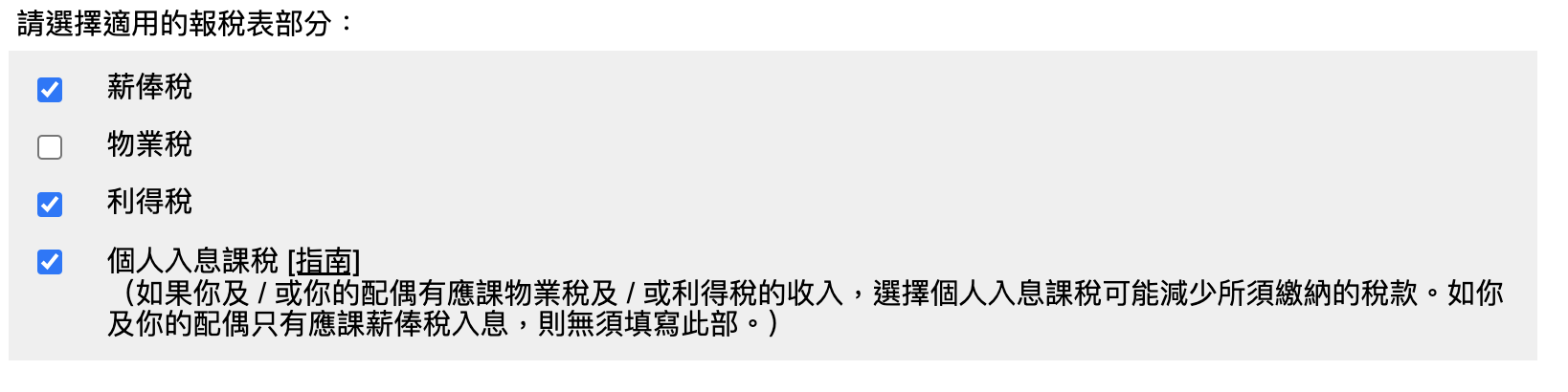

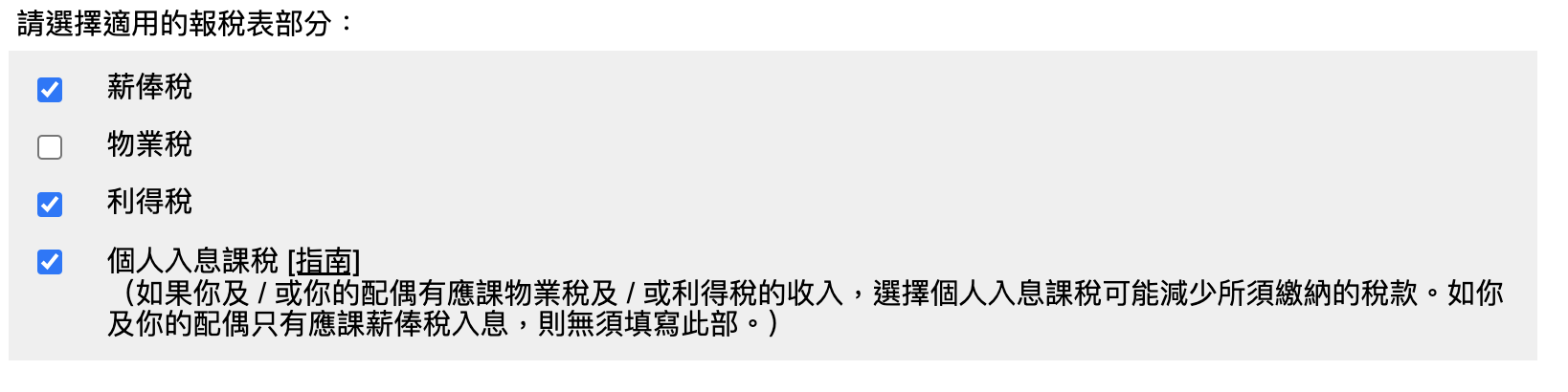

用你條link

禁到(根 據 以 上 資 料 , 你 選 擇 個 人 入 息 課 税 會 較 為 有 利 。)

咁我照剔薪俸稅+個人入息課稅

1. 薪俸稅個part有得打收入數目

2. 個人入息課稅個part係無得打收入個數目

咁個人入息課稅 條數點先交到上去?

條數點先交到上去?

係咪稅務主任問個陣到時先交

thanks

禁到(根 據 以 上 資 料 , 你 選 擇 個 人 入 息 課 税 會 較 為 有 利 。)

咁我照剔薪俸稅+個人入息課稅

1. 薪俸稅個part有得打收入數目

2. 個人入息課稅個part係無得打收入個數目

咁個人入息課稅

條數點先交到上去?

條數點先交到上去?係咪稅務主任問個陣到時先交

thanks

你第一句就話人抆水又見人哋返去溫下書先,好難同你討論wor ching 我明你係真internatinal tax professional, 俾一個tax advise 要好多consideration,但你都唔可以人哋一討論你個professional area就叫人哋返屋企架。

我明你係真internatinal tax professional, 俾一個tax advise 要好多consideration,但你都唔可以人哋一討論你個professional area就叫人哋返屋企架。

我明你係真internatinal tax professional, 俾一個tax advise 要好多consideration,但你都唔可以人哋一討論你個professional area就叫人哋返屋企架。

我明你係真internatinal tax professional, 俾一個tax advise 要好多consideration,但你都唔可以人哋一討論你個professional area就叫人哋返屋企架。咁個人入息課稅唔係稅種,係將你薪俸稅、100%擁有物業嘅物業稅、100%擁有無限公司即係獨資業務嘅利得稅,加埋後用一個標準同你評稅。

你etax定hardcopy都係報物業收入、薪金收入、扣減項目同獨資業務盈餘或虧損

你etax定hardcopy都係報物業收入、薪金收入、扣減項目同獨資業務盈餘或虧損

(你etax定hardcopy都係報物業收入、薪金收入、扣減項目同獨資業務盈餘或虧損)

你呢句意思係咪我係要剔

薪俸稅+個人入息課稅呢兩樣

但要將個人入息課稅個收入加落薪俸稅個個收入先可以?

你呢句意思係咪我係要剔

薪俸稅+個人入息課稅呢兩樣

但要將個人入息課稅個收入加落薪俸稅個個收入先可以?

剔哩三個格

個人入息課稅唔係一類稅種,佢只係換一種評稅方法畀你

第五部分剔利得稅,申報獨資業務財務資料

個人入息課稅唔係一類稅種,佢只係換一種評稅方法畀你

第五部分剔利得稅,申報獨資業務財務資料

唔該晒

其實我已經澄清左2次, 只係你堅持向著壞方向interpret

返屋企溫書有咩問題?我做左10年Tax,個人/公司,direct/indirect,唔少國家店過,in-house/pro firm做過…到今日都仲係屋企溫緊書,而覆你E一刻,我溫緊UK VAT⋯唔通你覺得6年audit, 2年tax, 就好夠水答international tax野?

以下係未進入tax 前,濃縮左ge 考慮。

我一直強調唔可以assume source of employment係HK….主因係公司一般會好重視PE risk. 一中PE, 接著就係Corp tax, local tax, SC, TP, VAT, other compliance cost…當assume佢係HK employment時,你幾乎係講緊, 香港有間公司send左條友, who is under the name of HK Co., 代表去英國做野, 而E條友會足足留成300-360日…樓主你覺得公司PE risk 如何?而你上面仲要暗示E個係common 現象,反而我列出其他可能就天馬行空? 其實你可以同你ge senior frd check下,佢手頭上有幾多cases in which 係外國人黎HK,但佢用緊home country employment, 而stay in HK高達300-365日。

E個concept其實都反映左現象, 外國big4准許佢地EE返返 home country WFH, 但policy限制佢地停留時間, 長短subject to唔同地方…grading ge限制亦唔同. PE係原因,當然亦有其他non tax 因素入面。。但無論點,無一間係容許WFH成年, 除非佢地「自制WFH」,偷偷地走唔比公司知,咁E個係題外話。

由於international arrangement涉及多個jurisdictions, 有公司係會直接engage pro firm幫佢地睇埋employment contract, 從而排除好多uncertainty, 亦都為之後鋪路, 可以HK,可以Non-HK, 更加可以係Dual, 香港出糧得, 外國出糧再recharge亦得,可能性好多…當然亦可以嘈話巴打細公司,唔理tax risk,好informal, 所以HK亦係一個可能性

進入tax 部分,私人關係,唔想分享太多,唔得閒,我之前同上面已經打左好大段⋯關鍵係,無論係HK exemption claim, 還是UK tax credit, 主指在於avoid double taxation,而taxing right偏向係UK個邊,加上UK稅重,主要睇UK, HK做副

UK Tax resident 只係開始, 唔係所有。個位巴打屬於non-UK domicile under domicile of origin category, 換言之,佢ge tax position同local有好大分別⋯只要佢做一個選擇,什至乜都唔做,都可令HK exemption claim受影響,什至直接收皮(assume 係樓主個60day case)…再加上, 我先前已經講左, HK tax 係好特殊,什至係古老ge tax system, 而UK先真係individual/personal income tax…that means個位巴打幾有錢(not just salaries income),直接影響佢UK tax position, 其3巴打亦提及埋佢係英國有第二份工,佢E份工係會為佢UK tax position 添加左未知…

簡單一句,基於佢上面提供資料,我無辦法答到2邊tax會點。亦唔想深究,因為好食我時間,我係要返屋企溫書,搵返晒UK CTA,同ITA2007野睇

返屋企溫書有咩問題?我做左10年Tax,個人/公司,direct/indirect,唔少國家店過,in-house/pro firm做過…到今日都仲係屋企溫緊書,而覆你E一刻,我溫緊UK VAT⋯唔通你覺得6年audit, 2年tax, 就好夠水答international tax野?

以下係未進入tax 前,濃縮左ge 考慮。

我一直強調唔可以assume source of employment係HK….主因係公司一般會好重視PE risk. 一中PE, 接著就係Corp tax, local tax, SC, TP, VAT, other compliance cost…當assume佢係HK employment時,你幾乎係講緊, 香港有間公司send左條友, who is under the name of HK Co., 代表去英國做野, 而E條友會足足留成300-360日…樓主你覺得公司PE risk 如何?而你上面仲要暗示E個係common 現象,反而我列出其他可能就天馬行空? 其實你可以同你ge senior frd check下,佢手頭上有幾多cases in which 係外國人黎HK,但佢用緊home country employment, 而stay in HK高達300-365日。

E個concept其實都反映左現象, 外國big4准許佢地EE返返 home country WFH, 但policy限制佢地停留時間, 長短subject to唔同地方…grading ge限制亦唔同. PE係原因,當然亦有其他non tax 因素入面。。但無論點,無一間係容許WFH成年, 除非佢地「自制WFH」,偷偷地走唔比公司知,咁E個係題外話。

由於international arrangement涉及多個jurisdictions, 有公司係會直接engage pro firm幫佢地睇埋employment contract, 從而排除好多uncertainty, 亦都為之後鋪路, 可以HK,可以Non-HK, 更加可以係Dual, 香港出糧得, 外國出糧再recharge亦得,可能性好多…當然亦可以嘈話巴打細公司,唔理tax risk,好informal, 所以HK亦係一個可能性

進入tax 部分,私人關係,唔想分享太多,唔得閒,我之前同上面已經打左好大段⋯關鍵係,無論係HK exemption claim, 還是UK tax credit, 主指在於avoid double taxation,而taxing right偏向係UK個邊,加上UK稅重,主要睇UK, HK做副

UK Tax resident 只係開始, 唔係所有。個位巴打屬於non-UK domicile under domicile of origin category, 換言之,佢ge tax position同local有好大分別⋯只要佢做一個選擇,什至乜都唔做,都可令HK exemption claim受影響,什至直接收皮(assume 係樓主個60day case)…再加上, 我先前已經講左, HK tax 係好特殊,什至係古老ge tax system, 而UK先真係individual/personal income tax…that means個位巴打幾有錢(not just salaries income),直接影響佢UK tax position, 其3巴打亦提及埋佢係英國有第二份工,佢E份工係會為佢UK tax position 添加左未知…

簡單一句,基於佢上面提供資料,我無辦法答到2邊tax會點。亦唔想深究,因為好食我時間,我係要返屋企溫書,搵返晒UK CTA,同ITA2007野睇

多謝ching 分享,學到嘢

你所講嘅PE risk 嘅意思係因為未必知道俾你去英國做嘢嘅果間公司在英國有冇PE, for example 英國分部,再者嘅喺本身呢個staff嘅function ,例如佢唔係做supporting function 好似accounting Finance 呢啲,佢係做sales side, 咁變咗個staff本身已經可能構成咗一個PE,係唔係?

你所講嘅PE risk 嘅意思係因為未必知道俾你去英國做嘢嘅果間公司在英國有冇PE, for example 英國分部,再者嘅喺本身呢個staff嘅function ,例如佢唔係做supporting function 好似accounting Finance 呢啲,佢係做sales side, 咁變咗個staff本身已經可能構成咗一個PE,係唔係?

1- 唔係. 而係當佢派條友去UK, 仲留成成年, 有機會多得E 條友變左香港係英國有PE under CTA2010或者S1141,如果佢本身無PE的話。但如果佢本身外國就有分部,就變左多多一個PE係UK, 成個structure 就係亂.

2- 係,不過你將佢簡單化左好多(Finance都唔一定無PE, 尤其treasury, 都要睇佢公司做乜,同tittle;又例如trading firm有機會有research/economist, 佢地都有機會中)…UK PE 基本上follow OECD. 而OECD其實keep都有updates…5,6年溫UK tax 時,溫過OECD convention & commentaries,本野厚過聖經,裡面比左好多例子,有時間我都想溫返..

2- 係,不過你將佢簡單化左好多(Finance都唔一定無PE, 尤其treasury, 都要睇佢公司做乜,同tittle;又例如trading firm有機會有research/economist, 佢地都有機會中)…UK PE 基本上follow OECD. 而OECD其實keep都有updates…5,6年溫UK tax 時,溫過OECD convention & commentaries,本野厚過聖經,裡面比左好多例子,有時間我都想溫返..

想色

拎間dormant 去睇下畀咩我

拎間dormant 去睇下畀咩我

咁啦,我開過個post remove 返個FAQ佢啦

你意思係會中咗s1141中 an agent acting on behalf of the company has and habitually exercises there authority to do business on behalf of the company.係唔係?

呢個情況係要去到咩extend先會中到其實,係唔係你第2段所講,就係如果trading firm, 有機會個research or economist 都會中?因為佢哋做緊嘅嘢都會directly affect 個間公司嘅business decision?定係真係要去到一個sales agent, 可以有authority to negotiate price or close deal先會中?

呢個情況係要去到咩extend先會中到其實,係唔係你第2段所講,就係如果trading firm, 有機會個research or economist 都會中?因為佢哋做緊嘅嘢都會directly affect 個間公司嘅business decision?定係真係要去到一個sales agent, 可以有authority to negotiate price or close deal先會中?

咁又唔洗巴打 條問題係幾好,比人參考吓都好ge, 可能之後+返句,情況會因人而言…條問題無指明係UK, 只係你答時用UK,我跟你UK, 而咁o岩UK係其中一個我較熟ge jurisdiction

條問題係幾好,比人參考吓都好ge, 可能之後+返句,情況會因人而言…條問題無指明係UK, 只係你答時用UK,我跟你UK, 而咁o岩UK係其中一個我較熟ge jurisdiction

我用Bloomberg 個tax tool…做左quick research(10mins)…at the first glance, 唔見Can n Aus有similar rule/election as UK, which affects the final tax payment. 即係話你轉左UK做其他國家, 個approach ge certainty大d

但都睇下有無其他人可以補充同confirm到

條問題係幾好,比人參考吓都好ge, 可能之後+返句,情況會因人而言…條問題無指明係UK, 只係你答時用UK,我跟你UK, 而咁o岩UK係其中一個我較熟ge jurisdiction

條問題係幾好,比人參考吓都好ge, 可能之後+返句,情況會因人而言…條問題無指明係UK, 只係你答時用UK,我跟你UK, 而咁o岩UK係其中一個我較熟ge jurisdiction我用Bloomberg 個tax tool…做左quick research(10mins)…at the first glance, 唔見Can n Aus有similar rule/election as UK, which affects the final tax payment. 即係話你轉左UK做其他國家, 個approach ge certainty大d

但都睇下有無其他人可以補充同confirm到

我都同你道歉先 一開始俾你個態度搞到我起晒鋼

一開始俾你個態度搞到我起晒鋼

一開始俾你個態度搞到我起晒鋼

一開始俾你個態度搞到我起晒鋼

差唔多啦,平極都要2千一年,有啲會計師好心啲嘅可能會收你4到5千幫你咁多年當一份出,如果真係冇數的話,4年出一份都見過